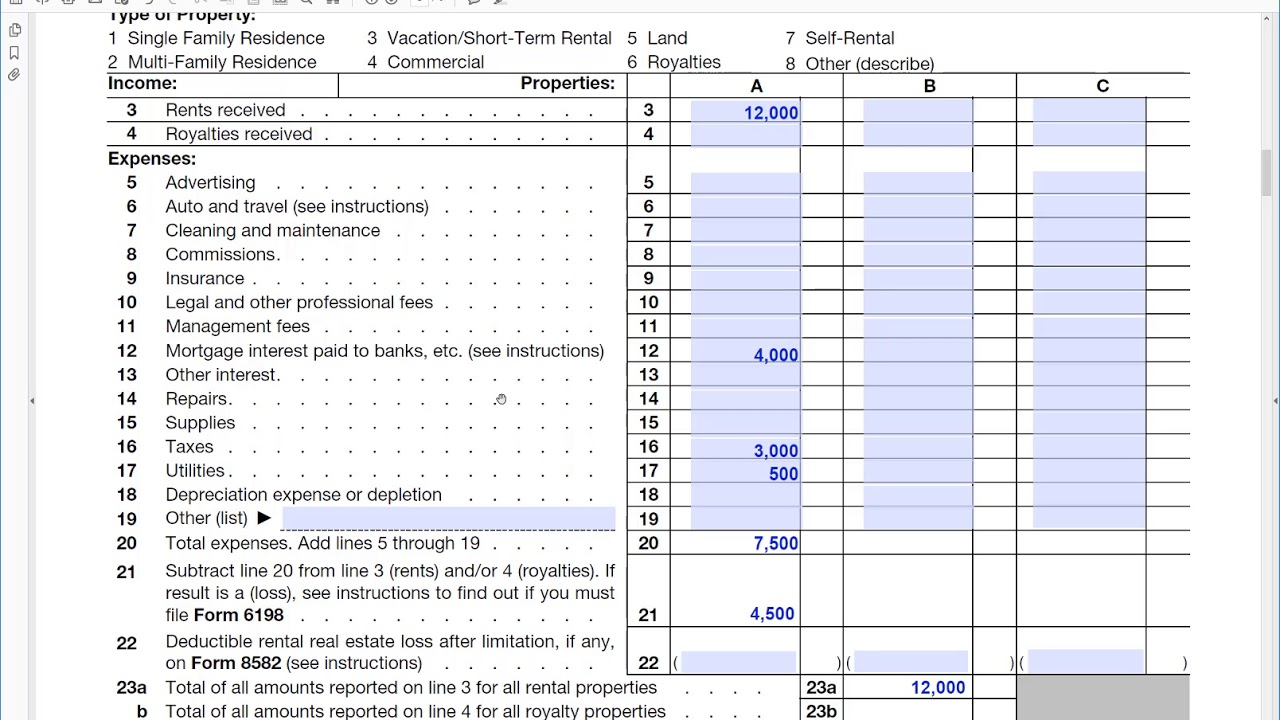

Schedule rental income irs loss fill Use the following information to fill out schedule e (tax form Tax form 1040 rental and royalty income schedule e

How to fill out IRS Schedule E, Rental Income or Loss - YouTube

Rental tax needed financial schedule return information file room Rental schedule income loss estate royalty real fillable pdf 1040 prepare expenses

Schedule property irs sample tax ultimate guide investors estate real improvements depreciate important value because why only

Tax form irs schedule 1 instructionFinancial information needed to file a tax return for your room rental Rental property schedule form irs mortgage claim interest doesPrepare tax rental property season schedule extended forms easy these make.

How to fill out irs schedule e, rental income or loss1040 irs earned foreign instruction The 2021 ultimate guide to irs schedule e for real estate investorsRental tax income schedule property properties taxes expat only interest mortgage completing explained list notice 2010 states united returns if.

Irs statement investors

Line losses rental estate real 1040 carried schedule activity form information over taxpayerIncome homeworklib 1040 rental supplemental Part 2: how to prepare a 1040-nr tax return for u.s. rental propertiesPrepare for the extended tax season with your rental property: these.

Fillable schedule e-11040 irs fillable income 1040x electronic Schedule e information for losses from rental real estate activity notCan you claim mortgage interest on rental property?.

How to fill out schedule e for real estate investments

The 2024 ultimate guide to irs schedule e for real estate investorsUs expat taxes explained: rental property in the us Nr 1040 tax prepare rental properties return part rents received schedulePart 2: how to prepare a 1040-nr tax return for u.s. rental properties.

.

The 2021 Ultimate Guide to IRS Schedule E for Real Estate Investors

Part 2: How to Prepare a 1040-NR Tax Return for U.S. Rental Properties

US Expat Taxes Explained: Rental Property in the US

Prepare for the Extended Tax Season With Your Rental Property: These

Can You Claim Mortgage Interest on Rental Property? - Bright Hub

The 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Schedule E Information For Losses from Rental Real Estate Activity Not

Tax Form IRS Schedule 1 Instruction | 24 Bit Deposit

Financial Information Needed to File A Tax Return For Your Room Rental